Tag insurance

A federal court has found that the insurer of a non-profit is not liable for a $67,097,998 judgment awarded against its insured for a fatal 2017 apartment fire in Oakland, California, due to the insured’s failure to disclose that it was the… Continue Reading →

Aon Hussain is an associate in the Insurance Practice. He represents insurers in litigation and non-litigation matters related to commercial general liability coverage, first party property coverage, and excess/umbrella liability coverage. Many of his cases require the defense of common… Continue Reading →

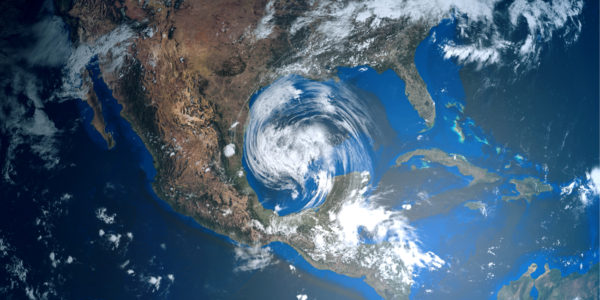

The year 2017 has not been too kind. In late August, Hurricane Harvey ravaged Texas. Initial estimates for damages related to Harvey are between $70 billion and $108 billion. Now, Florida and its neighbors in the Southeast are experiencing the… Continue Reading →

Many times, significant losses occur on property where the named insured owes delinquent property taxes. Certain states have codified laws mandating that, in such scenarios, a property insurer first pay delinquent property taxes from fire loss proceeds prior to paying… Continue Reading →

By Aon Hussain Tressler’s Property Line has taken a keen interest on whether labor can be depreciated in determining the actual cash value (ACV) of a first party property loss. Aside from creating a 50 State Survey on ACV and… Continue Reading →

In Paros Properties LLC v. Colorado Cas. Ins. Co., rainfall caused a substantial flow of water, mud and debris onto an insured’s property, causing extensive damage. The insurer disclaimed coverage for damages related to the rainfall on the basis of… Continue Reading →

Proposition 103, enacted in California in 1988, requires approval by the California Department of Insurance before implementing property and casualty rates. Proposition 103 also allows for policyholders to participate in the process setting rates for auto and property insurance. Since… Continue Reading →